When it comes to investing in graphite, understanding share price trends is crucial for making informed decisions. Graphite is a form of carbon that has gained popularity due to its diverse applications in industries such as batteries, lubricants, and construction. As an investor, tracking the movement of graphite share prices can provide valuable insights into market sentiments, industry trends, and potential investment opportunities. In this article, we will delve into the importance of analyzing graphite share price trends and explore some strategies to effectively interpret and capitalize on this information.

Understanding Graphite Market Dynamics

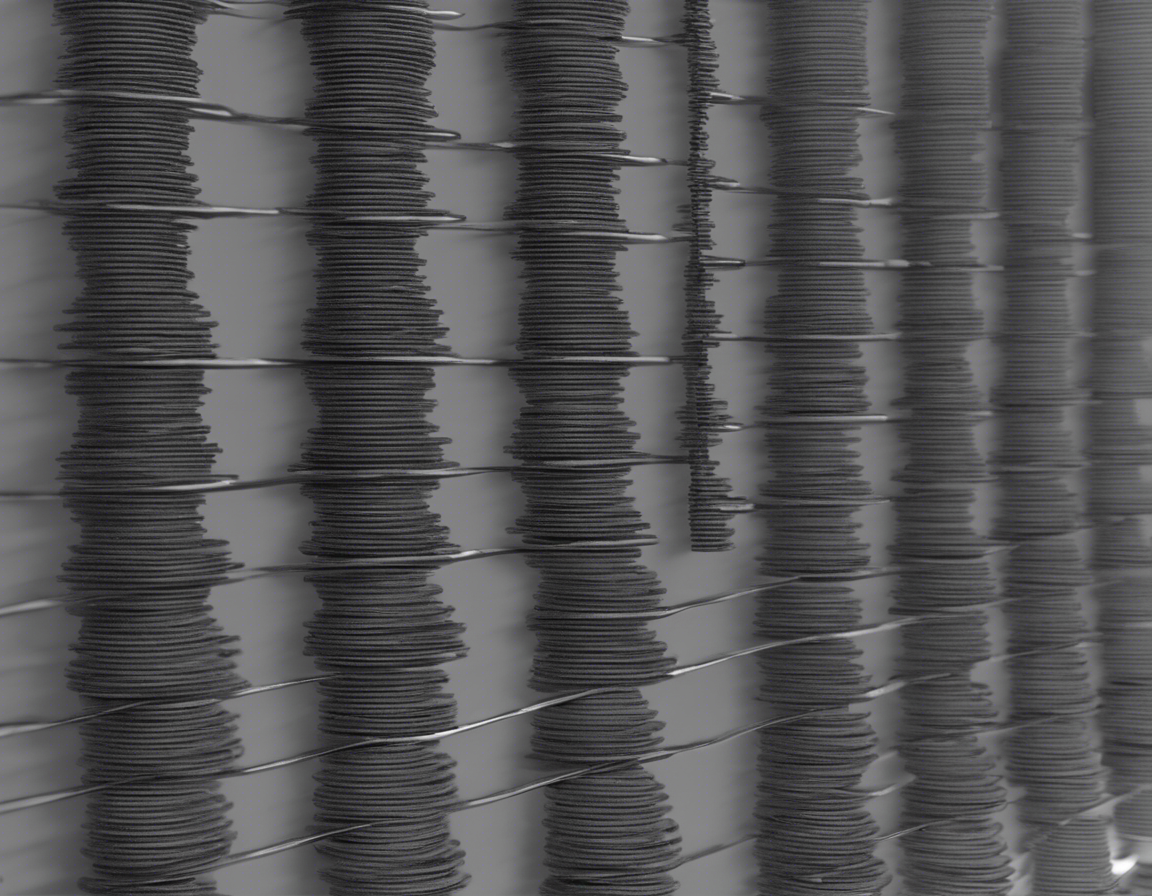

Before delving into share price trends, it’s essential to grasp the fundamentals of the graphite market. Graphite is a critical component in the production of lithium-ion batteries, which are widely used in electric vehicles (EVs) and renewable energy storage systems. With the increasing focus on sustainability and clean energy solutions, the demand for graphite is expected to surge in the coming years.

Factors Influencing Graphite Share Prices

Several factors can impact the share prices of graphite companies:

-

Supply and demand dynamics: Shifts in supply and demand for graphite can significantly influence prices. Factors such as new mining projects, technological advancements, and changes in consumer preferences can impact the balance between supply and demand.

-

Regulatory environment: Changes in regulations related to environmental standards, mining practices, or trade policies can affect graphite prices. Investors should stay informed about regulatory developments that could impact the industry.

-

Competition: The competitive landscape within the graphite industry can impact share prices. Companies that innovate, expand their product offerings, or secure strategic partnerships may experience growth in their stock prices.

-

Macroeconomic factors: Economic indicators, such as GDP growth, inflation rates, and interest rates, can also influence graphite share prices. Global economic conditions and geopolitical events can create volatility in the market.

Analyzing Graphite Share Price Trends

To effectively analyze graphite share price trends, investors can utilize various tools and techniques:

-

Technical analysis: This approach involves evaluating historical price data, volume trends, and market indicators to identify patterns and predict future price movements. Common technical analysis tools include moving averages, relative strength index (RSI), and MACD (Moving Average Convergence Divergence).

-

Fundamental analysis: Investors can assess the financial health and performance of graphite companies by analyzing key metrics such as revenue growth, earnings per share (EPS), and debt-to-equity ratio. Fundamental analysis helps investors understand the underlying value of a company’s shares.

-

Market sentiment: Monitoring market sentiment through news, social media, and analyst reports can provide insights into investor perceptions and expectations. Positive or negative sentiment can impact share prices in the short term.

Strategies for Interpreting Graphite Share Price Trends

When interpreting graphite share price trends, investors can consider the following strategies:

-

Long-term vs. short-term trends: Distinguishing between long-term trends, which reflect the broader outlook for the graphite industry, and short-term fluctuations, which may be influenced by temporary factors, can help investors make informed decisions.

-

Comparative analysis: Comparing the performance of graphite companies within the industry can help identify outliers and assess relative value. Investors can analyze factors such as market share, growth prospects, and financial ratios to evaluate company performance.

-

Diversification: Investing in a diversified portfolio of graphite companies can help mitigate risk and capture opportunities across different segments of the market. Diversification spreads risk and reduces the impact of individual stock price movements.

-

Risk management: Setting clear stop-loss levels and profit targets can help investors manage risk and protect their capital. Establishing a risk management strategy based on individual tolerance for risk and investment goals is essential when trading graphite shares.

Frequently Asked Questions (FAQs) about Graphite Share Price Trends

1. What are the key applications of graphite that drive its demand in the market?

- Graphite is widely used in lithium-ion batteries, refractories, lubricants, and the steel industry due to its unique properties such as conductivity, heat resistance, and lubricity.

2. How do global economic conditions impact graphite share prices?

- Fluctuations in GDP growth, trade tariffs, and currency exchange rates can influence the demand for graphite products and subsequently affect share prices of graphite companies.

3. What role does technological innovation play in shaping graphite share price trends?

- Technological advancements in battery technologies, manufacturing processes, and graphite purification techniques can impact the competitiveness and profitability of graphite companies, thereby influencing their share prices.

4. What risk factors should investors consider when analyzing graphite share price trends?

- Investors should be aware of risks such as supply chain disruptions, regulatory changes, competitive pressures, and commodity price volatility when evaluating graphite share price trends.

5. How can investors stay informed about graphite market developments and share price trends?

- Investors can utilize financial news sources, industry reports, analyst recommendations, and corporate filings to stay updated on graphite market dynamics and make informed investment decisions.

In conclusion, analyzing graphite share price trends requires a combination of industry knowledge, market analysis, and investment strategies. By understanding the factors influencing graphite prices, employing analytical tools, and adopting effective investment approaches, investors can navigate the dynamic graphite market with confidence and seize opportunities for growth and profitability.